Table of Contents

alvarez

With calories costs in Europe skyrocketing, putting industry backside strains in triage mode, a harsh wintry weather may just position sure car sectors susceptible to being not able to stay their manufacturing strains operating.

The blended black swan occasions of the COVID-19 pandemic and the Russian invasion of Ukraine have already stretched the car provide line – particularly in regard to semiconductors. Now, some OEMs and providers with energy-intensive production processes might face in depth power with regards to calories prices within the coming months.

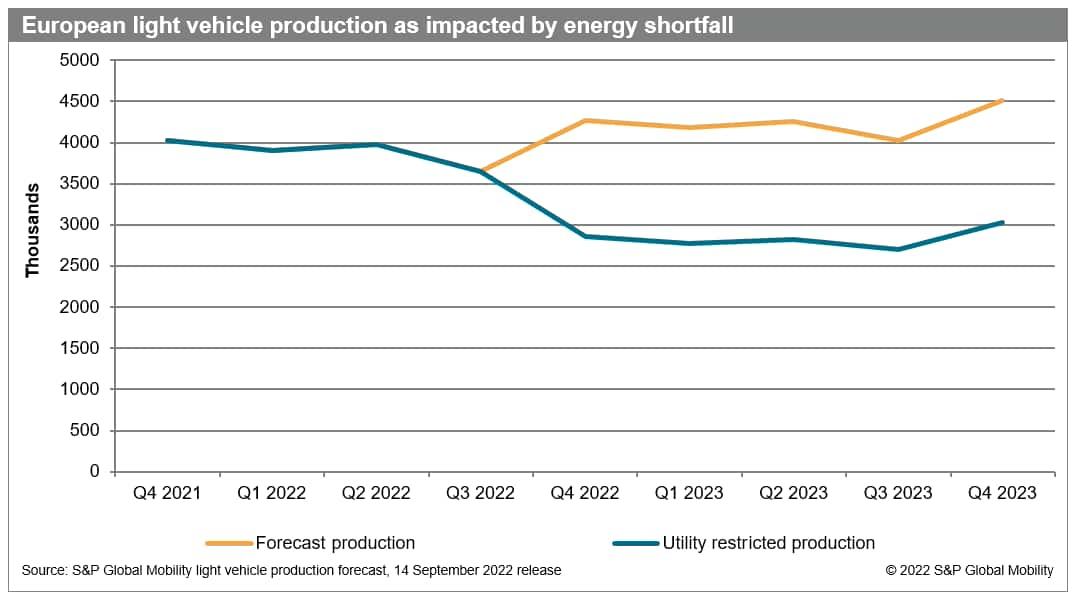

In consequence, possible production losses from Europe-based OEM final-assembly crops may just succeed in greater than 1 million devices in line with quarter, beginning within the fourth quarter of 2022 in the course of the entirety of 2023, consistent with forecasts through S&P International Mobility and S&P Commodity Insights.

Beginning within the fourth quarter of 2022 via 2023, quarterly manufacturing from Europe-based auto production crops used to be forecast to be within the 4-4.5-million-unit vary in line with quarter – predicting reasonable enlargement. Then again, with possible application restrictions, that OEM output might be diminished to as little as 2.75-3 million devices in line with quarter.

As observed with previous regional occasions – Ukraine-sourced neon shortages hampering semiconductor deliveries, and the 2011 Japan earthquake and tsunami crippling provides for microcontrollers, mass-airflow sensors, and Xirallic paint pigments – shedding one an important piece within the international provide chain can convey the car production {industry} to a crunching halt.

The consensus forecasts for a chilly, rainy Eu L. a. Niña wintry weather, blended with calories shortages, may have a an identical impact. The hot leaks within the subsea Russian pipelines to Europe provides to menace and the possibility that our fashion is directionally right kind.

S&P International Mobility is forecasting meaningful provide chain disruption from November via spring. We additionally await disruption of the normal just-in-time provide fashion because of some providers imposing a time table of operating fractional-months on a 24/7 setup – which will also be extra energy-efficient than conventional weekly shifts because of the latter’s upper start-up and shut-down calories prices.

We believe necessary calories rationing to be the root for a pessimistic state of affairs for the area’s auto manufacturers and providers. For an {industry} already suffering with low inventories of cars in broker showrooms, an extra disaster might be incapacitating on an international scale.

Eu providers ship portions, elements, and modules to OEMs around the globe – thus impacting all automakers, now not simply regional ones. And U.S. retail consumers may just additionally endure, as EU/UK production crops are these days exporting about 7,000 devices per thirty days to American shores – however shipped 213,750 cars within the entirety of 2019, consistent with International Industry Atlas.

“If you happen to glance in the course of the provide chain – specifically the place there is any steel construction forming via urgent, welding or extrusion – there is a super quantity of calories concerned,” mentioned Edwin Pope, Fundamental Analyst, Fabrics & Lightweighting at S&P International Mobility. “Overall calories utilization in those firms might be as much as one-and-a-half occasions what we are seeing in automobile meeting as of late. Anecdotally, we are listening to that a few of this production capability is changing into so uneconomic that businesses are merely shutting up store.”

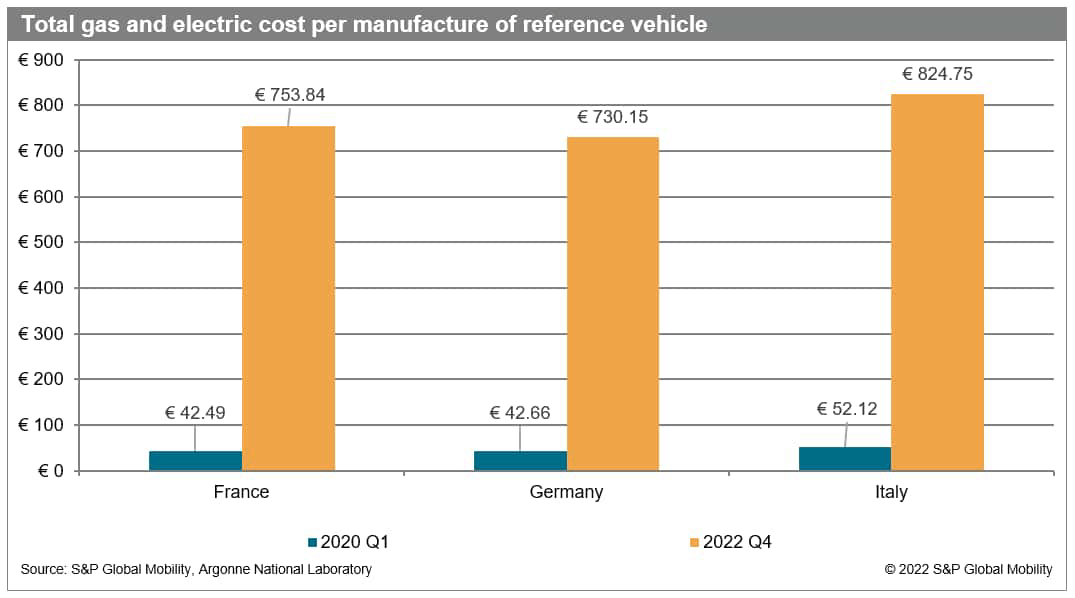

Earlier than the calories disaster, gasoline and electrical prices have been a rather inconsequential element of a automobile’s invoice of fabrics, most often not up to €50 in line with automobile. Now with price will increase starting from €687 to €773 in line with automobile, calories prices compound an already perilous place for the field – given the have an effect on uncooked subject matter value will increase have already had at the nascent electrical automobile price chains. Each serve to undermine margins in a marketplace the place price will increase can be tough to go directly to consumers already dealing with meals and effort inflation.

Around the Eu Union, calories constraints may just lead to countries or areas enacting emergency insurance policies to counter this danger. OEMs even have a sure point of countervailing energy with the regional application firms and by the use of governmental lobbying operations.

“Then again, the power at the car provide chain can be intense, particularly the extra one strikes upstream from automobile production,” Pope mentioned. “Upstream provider portions manufacturing constraints may just have an effect on OEM volumes. In consequence, we see a menace of OEMs halting shipments of finished cars because of shortages of unmarried elements, which don’t seem to be essentially coupled to country-level calories insurance policies.”

How international locations will have the ability to react

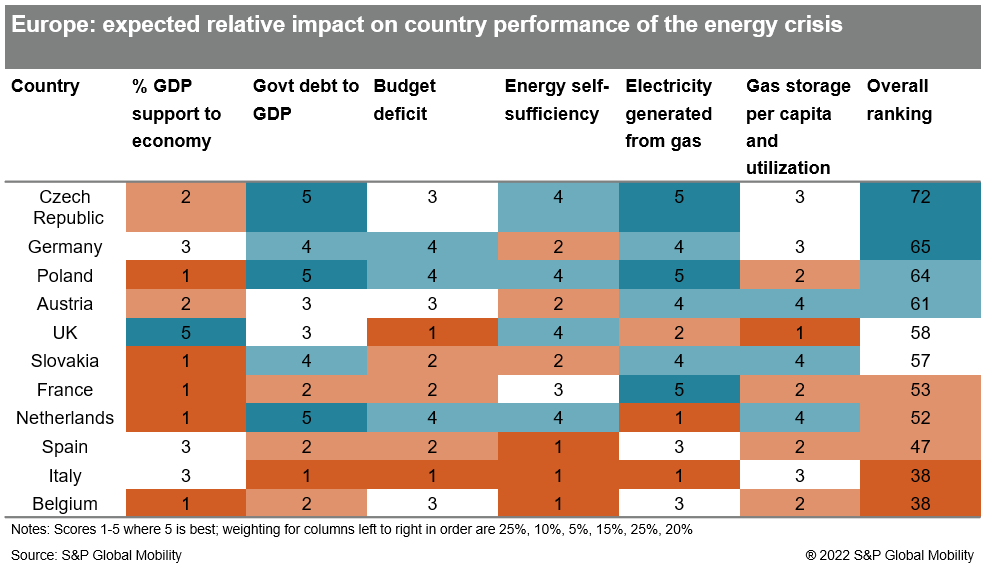

S&P International Mobility has modeled the have an effect on of the looming calories crunch on 11 Eu international locations – each and every an important automobile manufacturing location – to evaluate which international locations’ car segments are absolute best located to resist the serious calories headwinds this wintry weather.

The fashion borrows from macroeconomic combination call for frameworks in assessing intake, funding, and govt expenditure to which an review of calories combine and gasoline garage is added. According to a quantitative review of to be had data, six dimensions are scored on a relative foundation between 1 and 5, with 5 being the most productive rating.

The impact the calories disaster may have on a rustic’s financial efficiency and societal wellbeing may also be hooked up to a rustic’s commercial footprint. Probably the most calories extensive commercial sectors are aviation and transport, however their calories intake is tied nearly solely to grease, the place value will increase have now not been of the magnitude observed in gasoline and electrical energy. Business sectors that see top utilization of gasoline and electrical energy come with chemical compounds and steel merchandise, either one of which might be intrinsically tied to car production.

Person international locations’ coverage responses in addressing calories imbalances may also have an effect on comparative financial efficiency. Such insurance policies will resolve how a rustic’s calories combine affects the comparative benefit of automobile construct places in Europe.

That have an effect on is proven through some counterintuitive ends up in the S&P International Mobility research. Germany has depended on Russia for its gasoline provides and is phasing out nuclear energy, either one of which would appear to position that country in a precarious calories scenario. Then again, Germany advantages from its govt’s well-known fiscal rectitude, which provides it rather extra budgetary headroom to trip out the calories typhoon. Additional, the rustic advantages from a rather low reliance on electrical energy era derived from gasoline and from being in a tight place from a gasoline garage point of view.

The fashion additionally finds how an important govt intervention in family and {industry} give a boost to has been for the United Kingdom. Up to now few weeks, the United Kingdom govt has introduced measures including up to a few GBP200 billion for shoppers and {industry} – accounting for just about 7% of the rustic’s GDP and greater than double the extent of its nearest rival Italy. With out such give a boost to, the United Kingdom could be close to the ground of the desk, ready very similar to that of Italy – which suffers doubly owing to its debt and funds deficit place in addition to its low calories self-sufficiency and reliance on gasoline energy for electrical energy era.

The chart additionally brings into focal point the relative place of a rustic’s macroeconomic place vis-à-vis calories and macroeconomic insurance policies. Italy is likely one of the extra susceptible economies, and this weak spot can be additional compounded through the relative price drawback its production base faces.

No longer all international locations can be impacted similarly through the calories marketplace imbalances roiling markets in Europe. That mentioned, it’s transparent that an technology of considerable, and inexpensive, calories is over – and this has surprised policymakers into various levels of reaction.

The have an effect on of calories costs

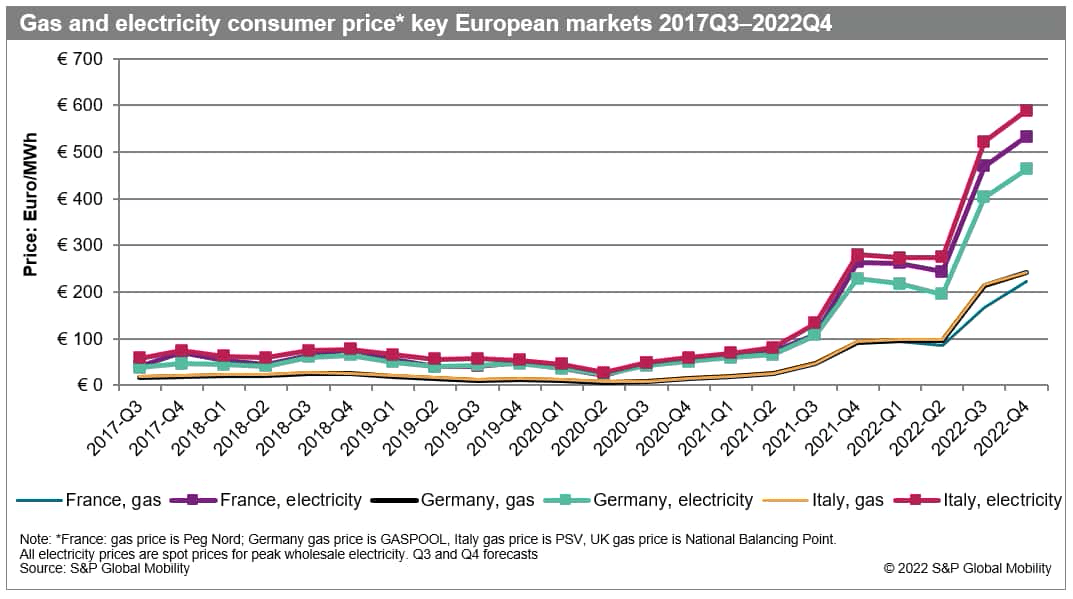

Since first quarter 2020, calories costs in Europe have soared. In keeping with S&P International Mobility information for 4 key markets – Italy, Germany, France and the United Kingdom – gasoline costs have larger through a median of two,183%, an element of just about 23. The wholesale electrical energy value larger through a median of one,230% or an element of greater than 13.

The have an effect on of the surge in costs is proven starkly within the next chart. Making use of calories costs from the beginning of 2020 and evaluating with the present scenario allows a view of the extra price that has been borne through OEMs. The next chart presentations the gasoline and electrical energy price building up for a normal reference automobile throughout France, Germany, and Italy.

For top-energy depth sectors like car production, S&P International Mobility has evolved a strategy, leveraging proprietary information property, to estimate the have an effect on on automobile production’s final analysis because of escalating calories prices.

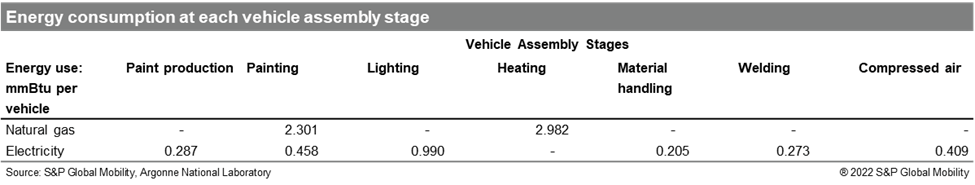

To permit for an apples-to-apples comparability in analyzing standard calories utilization in each and every level of ultimate meeting, the only reference automobile used used to be a Volkswagen Golfing MKVIII, tipping the scales at a coloration underneath 1,370 kg, and taking into account native calories combine.

There are some caveats to this technique. Carmakers once in a while supply their calories with other mixes than the rustic the place they function, whilst we suppose similar calories sourcing in our fashion. Automakers additionally have a tendency to fasten gasoline and electrical energy costs with utilities and use other monetary tools to scale back their publicity – to the purpose they frequently finally end up reporting meaningful windfalls from those hedging bets, as observed lately with the likes of Volkswagen and Daimler. In our fashion, we suppose they’re paying wholesale spot costs.

Ominous indicators for the provider tiers

Regardless of those caution indicators, some OEMs offer protection to their provider base through indexing the cost of key commodities per month for his or her providers, because of this that some providers don’t seem to be locked into contracts at an inelastic value level in the course of the duration of the contract. Then again, this tradition isn’t totally common.

“As you cross additional upstream, the sheltering the OEM supplies turns into much less,” Pope mentioned. “Moreover, smaller firms in Tiers 2 and three of the provision chain are prone to neither have the sources nor the operational sophistication required for hedging tools, ahead contracts and the like.”

The location Europe faces is also simplest temporary. A lot is dependent upon how the Russia-Ukraine war unfolds. Then again, a longer-term transformation of the calories image may just lead to structural penalties for the {industry}. This could see manufacturing schedules, production footprints and sourcing methods being discarded and changed with a shift to places the place the calories price burden is least. Whilst Europe faces a wintry weather of discontent now, extra disruption may just practice. This may occasionally convey basic upheaval to the area’s auto sector and past.

In the way in which that hard work price was a key determinant of producing location, calories combine and self-sufficiency may just grow to be key parts of long run sourcing selections.

Editor’s Observe: The abstract bullets for this text have been selected through Searching for Alpha editors.

https://seekingalpha.com/article/4546176-winter-coming-auto-industry-faces-significant-risk-exposure-from-looming-european-energy-crunch